This week, I’m joined by guest co-author and dear friend, Sri Varre.

Sri is a part of the Investment Team at Pivotal Ventures, where she's focused on investing in women-led funds and Series A to C companies. Her work spans from high-growth consumer and tech startups to social impact ventures, and organizations focused on gender equity issues. She's supported over 10 female-founded startups, working closely as a strategic partner to ops, marketing, product, and the C-Suite teams and stakeholders to execute successful launches, achieve operational and growth goals. Her experience fostering deep and long-lasting communities at the intersection of business, philanthropy, and gender equity led her to being a Washington Business Journal's DC Inno 25 Under 25 recipient and a previous TEDx Speaker. She's also the founder of No Cap Capital, a platform dedicated to closing the gender funding gap by amplifying the work of female founders and investors. She earned a BS in International Affairs and Economics from The George Washington University.

Climate change is no longer a distant threat—it’s a force reshaping where and how Americans live. As extreme weather events increase, the systems meant to provide safety and stability—particularly insurance—are starting to buckle. Since May 2023, State Farm and Allstate have stopped issuing new home insurance policies in California. In 2024, State Farm canceled 30,000 existing policies—one-third of those homes later burned. Today, insurance costs consume 20% of monthly mortgage payments, up from just 8% a decade ago. In disaster-prone regions, when private insurers pull out, state-run options often take over—at two to three times the cost.

Displacement and economic fallout are rising in tandem. Hurricane Ian caused over $100 billion in damages; the 2025 LA fires, an estimated $250 billion. Most homeowners are underinsured—covering only 80% of rebuild costs—while materials cost 20% more after disasters. With 67% of middle-class wealth tied up in homes, the stakes are high, and the financial gap is widening. In many cases, families can’t afford to rebuild, and they shouldn’t be expected to—especially in a system that continues to prioritize short-term development in high-risk zones. As a result, some experts now refer to the home insurance model as a "paper fiction"—a system propped up by assumptions of eventual government bailouts when the next major disaster strikes.

But this isn’t just about insurance. Climate change is quietly reshaping the geography and psychology of American cities. Over 5 million Americans are expected to relocate within the U.S. in 2025 due to climate-related risks—wildfire smoke, flooding, drought, and extreme heat. That number could rise to 55 million by 2055. Research shows only 5% of U.S. neighborhoods are considered “climate resilient”—nearly all of them concentrated in the Midwest. Consumer behavior is shifting too: 73% of homebuyers now consider climate risks when searching for a home, and 30% of people who moved in 2022 cited worsening weather as a major factor in their decision.

Yet within this disruption lies the potential to reimagine what homeownership, safety, and sustainability could look like. We’re in the early stages of a systems-level reset—one that demands not just new policies or price models, but entirely new ways of thinking about where and how we live. From the policy roots of the 1930s to the emerging innovations of 2025, this timeline explores how housing, wildfire tech, and climate insurance have evolved—and what it will take to build homes and communities that can truly withstand what’s ahead.

1930s

New Deal: FHA and Fannie Mae revolutionize homeownership with long-term mortgages. This comes in response to the Great Depression, which saw widespread foreclosures and a collapse in the housing market. The New Deal aimed to stabilize the economy and increase homeownership rates.

1940s–1950s

Suburban Boom: GI Bill (1944) accelerates suburbanization; Levittown, NY mass-produces affordable homes, selling for $9,000. This expansion is fueled by post-World War II economic growth, the baby boom, and increased automobile ownership. The Interstate Highway Act of 1956 further facilitates suburban sprawl.

1944

Wildfire Policy: "10 AM policy" and Smokey Bear campaign set aggressive fire suppression norms. This policy emerges from a desire to protect timber resources and responds to major fires in 1910 that took place in Idaho and western Montana. It inadvertently leads to fuel buildup in forests due to a combination of severe lightning and drought that past year, setting the stage for future mega-fires.

1970s–2008 | Regulation & Crisis

1970s

Energy & Housing Crunch: High mortgage rates spur new energy codes that reduced long-term housing costs; US Department of Housing and Urban Development (HUD) regulates manufactured homes (1976). This period is marked by stagflation, oil crises, and the end of the Bretton Woods system (the fixed exchange rate system provided monetary stability, which supported predictable interest rates. This environment made long-term housing loans more accessible and affordable, fostering homeownership growth in the U.S.), creating economic instability that impacts housing.

1991

Oakland Hills, CA Fire: Drives stricter Wildland-Urban Interface (WUI - the transitional zone where human development (homes and businesses) meets or intermingles with wildland vegetation) building codes (requirements for fire-resistant materials like non-combustible roofing). This fire destroyed 3,469 homes and apartment units across 2.5 square miles, killed 25 people, injured 150 others, and caused $3.9 billion in damages, occurring during a period of increased development in fire-prone areas, highlighting the growing risks of the WUI and climate change.

2000s

During the housing boom, developers rushed to build new homes, particularly in Sun Belt states like Florida, Arizona, and Nevada. This expansion often prioritized quantity over climate safety:

Urban Sprawl: The rapid construction of low-density suburban developments led to the destruction of natural habitats, increased car dependency, and higher greenhouse gas emissions from transportation.

Building in Risky Areas: Many homes were constructed in floodplains, wildfire-prone areas, or other environmentally sensitive zones. For example, in Spain’s housing bubble (a parallel case), 30% of homes damaged by floods were built in flood zones. Similarly, U.S. developments during this period ignored long-term climate risks.

Climate Risks Amplified by the Housing Crisis

The collapse of the housing market left millions of homes vacant or abandoned. These properties became more vulnerable to climate-related disasters:

Abandoned Properties: Foreclosed homes were often poorly maintained, increasing their susceptibility to damage from floods, hurricanes, or wildfires.

Reduced Resilience: The financial strain on homeowners and local governments after the crash reduced their ability to invest in climate adaptation measures like flood defenses or fireproofing.

2008–2020 | Recovery, Innovation & Investment

2008

Financial Crisis: TIn the early 2000s, banks gave risky "subprime" mortgages to people who couldn’t afford them, then repackaged these bad loans into complex investments called mortgage-backed securities (MBS). When housing prices dropped and borrowers defaulted, these investments collapsed like a house of cards. Nearly 4 million homes were foreclosed, wiping out $11 trillion in household wealth. Mortgages on climate-vulnerable homes are pooled into MBS without disclosing exposure to sea-level rise (SLR) or wildfires.

Outside of banks, the NFIP (The National Flood Insurance Program, which is housed under FEMA) and government-sponsored enterprises (GSEs) still to this day back mortgages in high-risk zones, effectively subsidizing climate-vulnerable housing.

Stillwater Dwellings emerges in this context, offering sustainable prefab homes as an alternative to traditional construction methods. This innovation responds to the need for more affordable, environmentally friendly housing options in the wake of the crisis.

2012

Wall Street Landlords: Blackstone's Invitation Homes institutionalized single-family home rentals across high-growth markets like Atlanta, Phoenix, and Dallas. As a result, it was claimed that Blackstone caused rents to increase by as much as 64% in some markets This trend emerges from the large inventory of foreclosed homes and represents a shift in the rental market landscape and raised concerns around affordability and displacement for the average American.

2015–2018

Housing Tech Surge: The surge is driven by a combination of factors, including:

Recovery from the 2008 crisis leading to renewed interest in housing innovation. Over the years, the market rebounded, with home prices growing by 51% since their lowest point in 2011.

Increasing housing costs in major cities creating demand for alternative solutions, such as modular construction, prefabricated housing, and accessory dwelling units (ADUs).

Growing awareness of climate change and the need for sustainable housing options

Advancements in technology enabling new approaches to construction and design (3D printing, smart homes, etc.)

Prefab startups like Cover (2014), Katerra (2015, later filed for bankruptcy in 2021, now Onx Homes), and Juno (2018) attract significant VC funding. California eases ADU regulations in response to the state's severe housing shortage.

Wildfire Tech Emergence: Startups (Redzone, Descartes Labs) enhance wildfire detection. This emergence is driven by:

Increasing frequency and severity of wildfires due to climate change. Fire seasons now start earlier in spring and extend later into autumn, lasting over a month longer in regions like the Western U.S., Mexico, and Brazil compared to 35 years ago

Growing wildland-urban interface putting more properties at risk

Advancements in AI, satellite technology, and data analytics

Early Warning System (EWS) emerged as critical tools for disaster risk management, offering real-time alerts to mitigate impacts. AI-driven predictive models and satellite-based monitoring have significantly improved outcomes.

Major fires prompt strategic shifts (2018 Camp Fire), highlighting the urgent need for better wildfire management technologies.

The deadliest wildfire in California history resulted in 85 fatalities and destroyed over 18,000 structures. It highlighted gaps in evacuation planning and fire management systems.

Temporary refuge areas saved over 1,200 civilians during the fire when evacuation routes became impassable due to gridlock.

Population declined 68.8% (26,532 to 8,285)

Insurance costs increased 36.8% ($2,178 to $2,979)

Property values declined 42.1% ($570,602 to $330,310)

2018–2019

Housing Innovation: ICON introduces 3D-printed homes (2018); Culdesac breaks ground on car-free communities (2019). These innovations build upon:

Affordable and Sustainable Housing Innovations: In 2018, ICON introduced 3D-printed homes, capable of being built in 24 hours for under $10,000, addressing the housing affordability crisis with cost-effective, disaster-resilient, and eco-friendly construction methods. By 2019, ICON partnered with New Story to build the world’s first 3D-printed community in El Salvador.

Car-Free, Community-Oriented Living: Culdesac broke ground on its first car-free community in Tempe, Arizona, in 2019. Designed to prioritize walkability, public transit, and shared spaces, the project eliminated parking infrastructure to reduce housing costs and promote sustainable, community-focused urban living.

Technological and Market Drivers: These innovations responded to a worsening housing affordability crisis (7.2 million affordable rental home shortage in the U.S.), growing demand for sustainable living (83% of residents preferred green communities), and advancements in technologies like 3D printing and modular construction that reduced costs and waste while accelerating building timelines.

2020–2023: Climate and Tech Convergence

2020

Wildfire & Housing Crisis: Record wildfires (over 10M acres burned); pandemic sparks historic housing boom and affordability crisis. This crisis is exacerbated by:

Climate change intensifying wildfire seasons

COVID-19 pandemic shifting housing preferences and work patterns

Supply chain disruptions and labor shortages in the construction industry

Federal Reserve's low interest rate policy fueling housing demand.

Firetech Boom: Pano AI (2019) uses AI-powered cameras; Convective Capital launches (2022), funding wildfire tech startups (Rainmaker, Overstory, FireAside). This boom is driven by:

Increasing wildfire risks and associated economic losses

Growing public and political awareness of the need for better wildfire management

Growing recognition of wildfire risks has led to significant legislative and strategic initiatives. The Wildfire Response and Drought Resiliency Act (passed in 2022) introduced measures such as a 10-year National Wildfire Plan, enhanced firefighter pay, investments in wildfire smoke research, and modernized risk reduction programs. Additionally, the Biden Administration’s Investing in America agenda has allocated historic funding for hazardous fuel treatments, reducing wildfire risks across millions of acres.

Advancements in AI, IoT, and remote sensing technologies.

Pano AI, launched in 2019, uses ultra-high-definition, 360-degree cameras and deep learning to detect wildfires in real time, reducing response times by 20–30 minutes. Its systems monitor over 6 million acres across the U.S. and Australia, helping first responders contain fires before they escalate.

The "Early Warnings for All" initiative launched at COP27 in 2022 aims to expand EWS coverage globally by 2027, potentially saving millions of lives.

Climate Risk Data: First Street Foundation releases Flood Factor (2020) and Wildfire Factor (2022) tools, reshaping homebuyer risk assessment. By 2023, 30% of CA insurers will integrate it into underwriting. This trend is influenced by:

Growing awareness of climate change impacts on property values

Insurance industry's need to better assess and price climate risks

Increasing demand from homebuyers for transparency about climate-related risks

Modular Housing: Samara (Airbnb spinoff, 2022) scales ADUs, raising $41M Series A (2023) while new iterations of climate insurance companies like Faura and Stand emerge. This development is driven by:

Ongoing housing affordability crisis in major urban areas

Changing regulations favoring ADU construction

Growing interest in flexible living spaces post-pandemic

In May 2023, State Farm announced it would stop accepting new applications for all business and personal lines of property and casualty insurance in California. This decision was driven by historic increases in construction costs, rapidly growing catastrophe exposure, and a challenging reinsurance market.

2024–2025: New Crises & Innovation Accelerate

2024

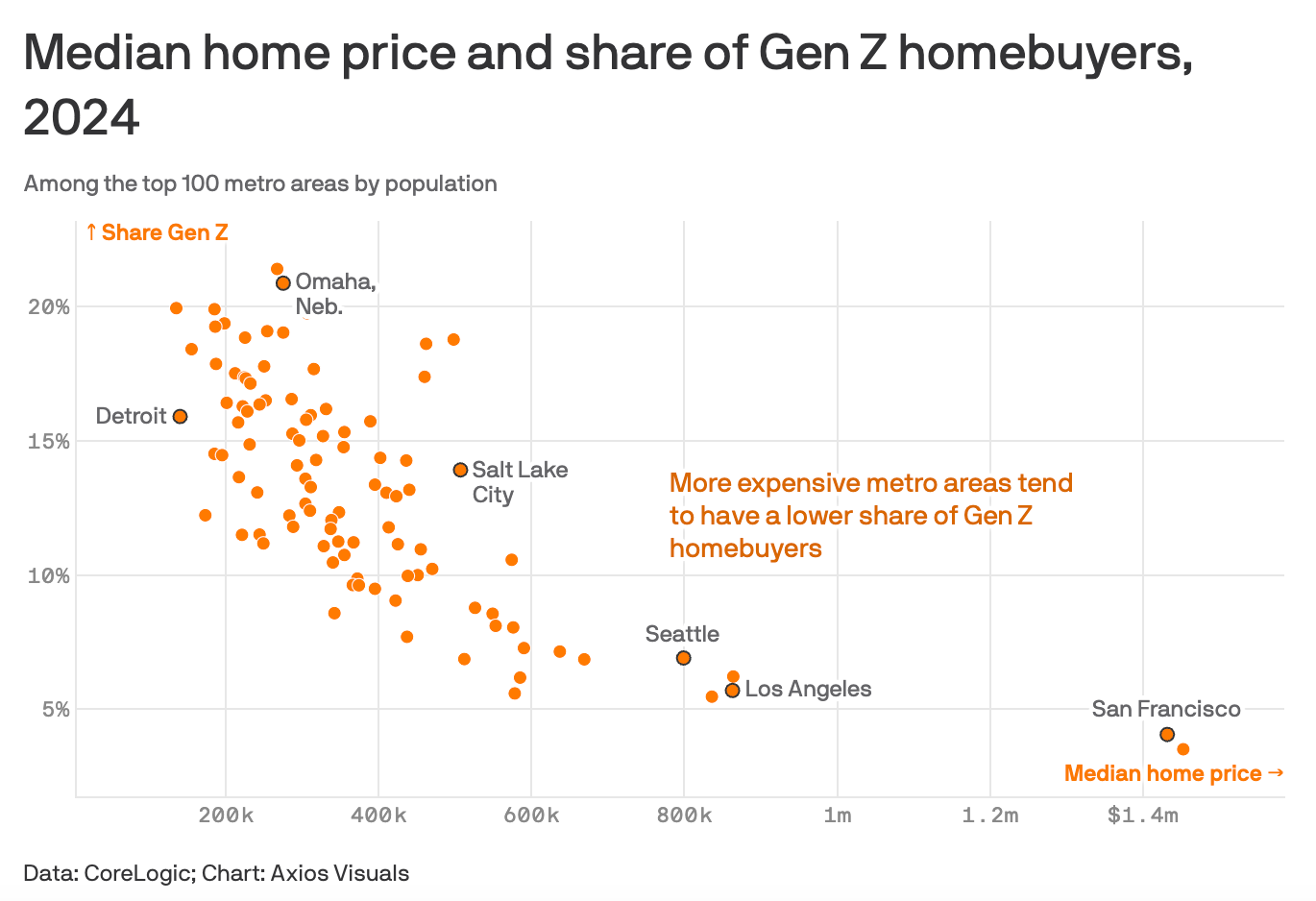

Gen Z Drives Housing Shift: Gen Z accounts for 10% of mortgage applicants, prioritizing climate-resilient, affordable, sustainable housing. This shift is influenced by:

Coming of age of the most environmentally conscious generation

Lingering economic impacts of the COVID-19 pandemic on young adults

Increasing awareness of climate change risks to property

Wildfire Robotics: Guoxing KT 500 bulldozer debuts, automating rapid wildfire containment. This innovation emerges from:

Increasing wildfire risks and the need for more efficient containment methods

Advancements in robotics and autonomous vehicle technology

Labor shortages in firefighting personnel

By April 2024, State Farm began notifying approximately 30,000 homeowners in California, particularly in high wildfire-risk zones, that their policies would not be renewed. This move affected several Bay Area ZIP codes, including parts of Sonoma, Santa Clara, and Contra Costa counties.

2025 Catastrophic LA Wildfires & Mudslides: Palisades Fire (January) destroys ~7,000 homes; subsequent March mudslides cause further devastation, prompting federal infrastructure resilience policies. This crisis is exacerbated by:

Prolonged drought conditions in California

Continued development in high-risk wildland-urban interface areas

Inadequate infrastructure and preparedness for extreme weather events

The irreversible impacts of this natural disaster are…

Economic impacts: The 2025 Los Angeles wildfires alone are estimated to cost between $250 billion and $275 billion, making it the costliest U.S. natural disaster in history. These losses include insured damages of $50 billion, widespread destruction of over 12,000 structures, and ripple effects such as reduced GDP and inflation pressures from rebuilding efforts.

Some landlords raised rental prices by as much as 30% after the fires despite anti-price gouging laws prohibiting rent increases over 10%; evictions can double after disasters according to research; total insured losses estimated to exceed $30 billion.

Destruction and displacement: Over 12,000 homes destroyed in the LA fires, displacing nearly 100,000 residents, with 11.2 million people (over 25% of California's population) living in areas of catastrophic wildfire risk.

Economic impacts: Some landlords raised rental prices by as much as 30% after the fires despite anti-price gouging laws prohibiting rent increases over 10%; evictions can double after disasters according to research; total insured losses estimated to exceed $30 billion.

Insurance crisis: State Farm dropped nearly 70% of its policies in Pacific Palisades; California FAIR Plan (state's "insurer of last resort") has only $377 million to pay out claims; home insurers continue to flee California and other disaster-prone markets.

Disproportionate community impacts: Altadena's Black homeownership rate was nearly twice the national average; one Black family with 20 relatives living in Altadena for over 50 years lost a total of 8 homes; housing impacts extend beyond physical destruction and affect residents beyond the fires' perimeter.

Systemic challenges: Natural disasters pose "unprecedented and multi-dimensional risks to housing security" nationwide; risks compound over time and deepen housing security issues across racial, socioeconomic, and geographic lines; housing-related disaster relief remains inadequate.

Data gaps: No system exists to measure how many people are displaced or return after disasters; accurate counts of displaced individuals and households frequently elude disaster recovery groups; administrative data from FEMA is incomplete and likely undercounts vulnerable groups like undocumented people and renters.

In February 2025, after devastating wildfires swept through Southern California, State Farm requested emergency approval from California regulators to increase insurance premiums by an average of 22%. This creates a substantial financial strain for homeowners already dealing with disaster recovery, potentially making insurance unaffordable when they need it most.

Emerging Housing Crisis (2025): Soaring interest rates and record-low affordability signal looming correction; home sales hit lowest point since 1995, prompting debate on market stability. This is influenced by:

Federal Reserve's efforts to combat inflation leading to higher mortgage rates

Lingering effects of the pandemic-era housing boom

Growing income inequality exacerbating housing affordability issues

Increasing costs of climate-resilient construction and insurance in high-risk areas

Our Takeaways

As the intertwined challenges of climate change, economic uncertainty, and housing affordability intensify, the need for bold, creative innovation in how we build, insure, and inhabit homes has never been greater. This generation faces a new reality—one shaped by extreme weather, rising costs, and a fragile labor market—demanding solutions that are not only resilient but also regenerative and at price-parity. From decarbonized concrete and prefab modular homes to wildfire detection tech and adaptive insurance models, the next frontier of housing innovation must tackle sustainability without sacrificing affordability or durability. In a landscape where third spaces have long gone, belief in the American Dream wanes, and institutional trust erodes, homes are evolving into hubs for communal living, education, and care economies. The convergence of AI and human creativity offers a chance for a more conscious, connected future, where climate resilience and human flourishing can coexist. The journey ahead is not just about rethinking spaces, but redefining how we live and thrive in a post-institutional world. Stay tuned as we dive deeper into communal living, care, and choice economies in our next article.

Climate Company Repository

Description: Prefabricated backyard homes and studios

Date of Inception: 2014

Funding to Date: $70M+

Milestones: Hundreds of units delivered, units reduce energy usage by 75% via high-performance insulation and HVAC systems

Sustainability Impact Modular methods reduce construction waste by ~83% and CO2 emissions by 35–43%

Lives Impacted: Thousands

Houses Built: Hundreds

End User: Homeowners seeking extra living space or rental income ($354K for 580 sq ft home)

Role in Natural Disasters: Quick, modular rebuilding after disasters

Current Valuation: $240M+

Investment Stage: Series B+

Investors: Gigafund, Founders First, General Catalyst

Description: Modular, sustainable apartments

Date of Inception: 2018

Funding to Date: $31M+

Milestones: Multiple multifamily projects underway

Lives Impacted: Hundreds

Houses Built: Multiple apartment complexes across Austin, Denver, and Seattle

End User: Urban renters seeking sustainable, affordable housing

Studio Apartments (457 sq ft): Rent starts at $2,000/month

One-Bedroom Apartments (685 sq ft): Rent starts at $2,500/month

Role in Natural Disasters: Durable and scalable housing solution

Current Valuation: $99M

Investment Stage: Series A Extension

Investors: Khosla, K50, Sugar Free Capital

Description: Wildfire mapping and risk analytics

Date of Inception: 2001

Funding Type: Incubator

Lives Impacted: Thousands indirectly

End User: Insurance companies, fire agencies

Role in Natural Disasters: Real-time fire tracking, improving disaster response

Investors: Lloyd’s Lab (London-based incubator)

Description: AI-driven geospatial analytics, specializing in processing and analyzing massive earth observation datasets

Date of Inception: 2014

Funding Type: VC & PE

Funding to Date: $97M

Milestones: Multiple large-scale deployments

Lives Impacted: Thousands indirectly

End User: Government agencies, corporations

Role in Natural Disasters:

Descartes Labs originated as a spin-off from Los Alamos National Laboratory and has been recognized for its innovations in geospatial data analysis and AI-powered solutions

The company’s wildfire detection system has been particularly impactful in mitigating risks associated with megafires by providing early warnings based on satellite imagery and advanced algorithms

Current Valuation: $250M

Investment Stage: recently acquired by EarthDaily Analytics through a leveraged buyout via Antarctica Capital

Investors: Crosslink Capital, Hemisphere Ventures

Description: 3D-printed affordable homes

Date of Inception: 2017

Funding to Date: $499M+

Milestones: Multiple neighborhoods completed

Lives Impacted: Thousands

Houses Built: Hundreds

End User: Low-to-middle income, affordable housing seekers

Role in Natural Disasters: Rapid, cost-effective post-disaster rebuilding

Current Valuation: ~$2B

Investment Stage: Series C

Investors: CAZ Investments, In-Q-Tel, 8VC, Citi Impact

Description: Car-free, walkable communities

Date of Inception: 2018

Funding to Date: $53M+

Milestones: 1 community completed, others in construction

Lives Impacted: Hundreds of residents

Houses Built: Hundreds of units

End User: Young professionals, families valuing sustainability and community

Role in Natural Disasters: Reduces dependency on vehicles, enhances community resilience

Current Valuation: $160M

Investment Stage: Series A Extension

Investors: Khosla Ventures, Wischoff Ventures, Caffeinated Capital

Description: Bridges health and affordable housing by embedding care teams within low-income housing properties to provide healthcare coordination, benefit enrollment, and social services.

Date of Inception: 2022

Funding to Date: $9.9M

Milestones: Serves over 6,500 residents across 30+ properties

Lives Impacted: 6,500+

End User: Residents of affordable housing properties

Current Valuation: $14M

Investment Stage: Seed

Investors: Metrodora, Flare Capital Partners

Description: AI-powered wildfire detection

Date of Inception: 2017

Funding to Date: $45M+

Milestones:

Hundreds of cameras deployed across nine U.S. states, Canada, and Australia.

Monitors nearly 20 million acres globally and has detected close to 100,000 fires

Lives Impacted: Thousands

End User: Emergency responders, local governments, utilities, private forest owners, and insurers

Role in Natural Disasters: Early wildfire detection and response

Current Valuation: $117M

Investment Stage: Series A

Investors: Congruent Ventures, January Ventures, Convective Capital, Initialized

Description: High-quality modular ADUs

Date of Inception: 2022 (spun off from Airbnb’s R&D team)

Funding to Date: $41M

Milestones: Samara recently acquired a factory in Mexicali for vertical integration to scale ADU production

Lives Impacted: Thousands

Houses Built: Hundreds

End User: Homeowners seeking additional housing flexibility

Role in Natural Disasters: Quick, flexible, scalable response to housing displacement

Current Valuation: $120M+

Investment Stage: Series A

Investors: 8VC, General Catalyst, Thrive Capital, SV Angel

Description: Develops precipitation enhancement technology using drones, weather modeling and cloud seeding techniques to address water scarcity for farms, watersheds, and ecosystems.

Date of Inception: 2023

Funding to Date: 21M

Milestones: Demonstrated results in increasing rainfall through advanced weather modeling and autonomous systems

End User: Farmers, utility operators, ecosystem restoration projects

Role in Natural Disasters: Mitigates droughts by enhancing precipitation and supporting water resilience efforts

Current Valuation: 70M

Investment Stage: Series A

Investors: Long Journey Ventures, Day One Ventures

Description: Builds sustainable homes using proprietary X+ Construction™ technology for resilience against natural disasters like hurricanes and wildfires

Date of Inception: 2021

Funding to Date: $120M

Milestones:

Over 5,000 homes under development across Florida and Texas

Builds homes in under 30 days using advanced construction methods

Recently broke ground on a community of 200 homes in Central Florida

Lives Impacted: Thousands through resilient housing solutions.

Houses Built: Thousands under development or completed across multiple states

End User: Homebuyers seeking disaster-resilient housing solutions

Role in Natural Disasters: Provides durable homes designed to withstand hurricanes and wildfires

Investment Stage: Series B

Investors: Celesya Capital, Lucas Venture Group

Description: Overstory’s platform tracks forests and vegetation at both territory-wide and tree-level scales using AI and remote sensing data. It identifies tree height, health, species, and proximity to power lines, enabling utilities to prioritize trimming and reduce wildfire risks.

Date of Inception: 2018

Funding to Date: $25M

Milestones: Monitored over 2 million acres of land

Safeguarded $6 billion worth of utility assets.

Partnered with 40+ electric utilities globally, including four of the top 10 U.S. utilities, innovative cooperatives, and leaders across Canada, Brazil, and Europe

End User: Utility companies such as Powder River Electric Cooperative, Holy Cross Energy, and Sho-Me Power Electric Cooperative have benefited from Overstory’s tools

Investment Stage: Series A

Investors: B Capital Group, Moxie Ventures, Nature Conservancy

Description: FireAside’s software manages vegetation and structural data at the parcel level. It automates wildfire prevention programs with tools like Defensible Space Inspection (DSI) reports and ChipperDay software for fuel removal

Date of Inception: 2020

Milestones:

Covers over 1 million residences across five states

Residents using FireAside are five times more likely to take action on defensible space recommendations

Marin Wildfire Prevention Authority evaluates over 30,000 properties annually using FireAside’s software

Truckee Fire District uses DSI tools to communicate wildfire mitigation steps tailored to individual homes

End User: Used by over 75 municipalities, trusted by 25 fire agencies and 16 counties

Role in Natural Disasters: tools to streamline inspections, grant applications, and resource allocation for fire prevention efforts

Investment Stage: Seed

Investors: Convective Capital

Description: Provides climate and property risk analytics for MGAs, carriers, and agencies to reduce natural disaster risk exposures.

Date of Inception: 2023

Funding to Date: $3.9M

Milestones: Assessed approximately 10,000 homes

End Users: MGAs (Managing General Agents) , policy carriers, agencies, and homeowners

Role in Natural Disasters: Assesses property vulnerability to wildfires, wind damage, and plans to include flood assessments

Investment Stage: Seed

Current Valuation: $13M

Investors: Harlem Capital, Responsibly Ventures

Description: Underwrites property insurance and revenue firming products for renewable energy assets

Inception Date: 2012

Funding to Date: $31M

Milestones: Insured over $30 billion in renewable energy assets

End Users: Renewable energy projects (solar, wind, storage)

Role in Natural Disasters: Provides insurance for renewable energy assets to mitigate risks like physical damage and revenue loss

Investment Stage: Series B

Current Valuation: $34M

Investors: Anthemis, Exvor Capital

Description: Provides insurance for carbon credits, replacing them if destroyed or invalidated

Date of Inception: 2022

Funding to Date: $17M

Milestones:

Oka's product suite includes "Carbon Protect," a data-driven underwriting platform that adjusts premiums based on project risks and evolving climate conditions

End Users: Large U.S. corporations purchasing carbon credits, including project developers, corporate sustainability teams, and financial institutions

Role in Natural Disasters: Protects against risks such as invalidation or destruction of carbon credits due to unforeseen events like wildfires or other climate-related disasters

Investment Stage: Series A

Current Valuation: $65M

Investors: Overview, Firstminute Capital

Description: Offers credit insurance products that enable financing for distributed energy resources (DERs), including solar, wind, and microgrids

Date of Inception: 2016

Funding Type: Venture-backed with additional grants from entities like the U.S. Department of Energy

Funding to Date: Over $10.5M; supported $500 million worth of projects with EneRate Credit Cover® policy

Milestones:

Supported over 1,400 sites across 46 states

Enabled $800 million in project value across renewable energy assets

Reduced carbon emissions by over 114,700 metric tons

End Users: Developers of DERs such as solar panels, microgrids, and EV chargers; low-income communities benefit significantly from the portfolio coverage

Role in Natural Disasters: Mitigates counterparty credit risk for clean energy projects to ensure financial viability during disasters or economic downturns

Stage: Series A

Current Valuation: $33M

Investors: Congruent Ventures, Powerhouse Ventures

Description: Stand Insurance provides insurance solutions tailored for natural disasters, focusing on financial protection and resilience for individuals and communities. Stand specializes in offering coverage for risks like wildfires, hurricanes, and floods, which are often excluded from standard homeowner policies.

Date of Inception: 2023

Funding to Date: $29M

End User: Homeowners, businesses, and communities at risk of natural disasters

Role in Natural Disasters: Provides financial protection to policyholders, enabling quicker recovery and rebuilding after disasters. Likely incorporates risk mitigation strategies into its offerings

Current Valuation: $89M

Investment Stage: Series A

Investors: Convective Capital, Inspired Capital, Equal Ventures

Climate Investor Repository (focused on housing, wildfire tech, and climate tech):

VC

PE